:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend-edit-e562d9d55b3c4f24b2dc11afc1adff04.jpg)

What Are Qualified Dividends, and How Are They Taxed?

Price: $ 9.00

5(486)

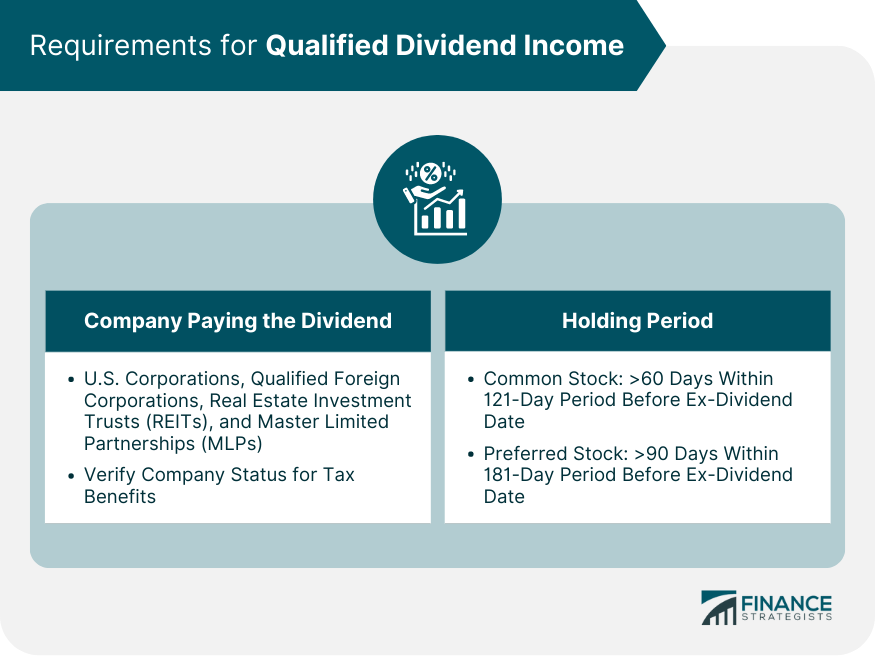

A qualified dividend is a payment to owners of stock shares that meets the IRS criteria for taxation at the capital gains tax rate.

How are Dividends Taxed and at What Rates?

Tax Calculator - Estimate Your Income Tax for 2023 and 2024 - Free!

Gauge your tax bracket to drive tax planning at year-end

2021 Taxes for Retirees Explained

Breaking Down Form 1099-DIV • Novel Investor

Qualified Dividend Income Definition, Tax Advantages, & Risks

Don't Forget Taxes When Comparing Dividend Yields

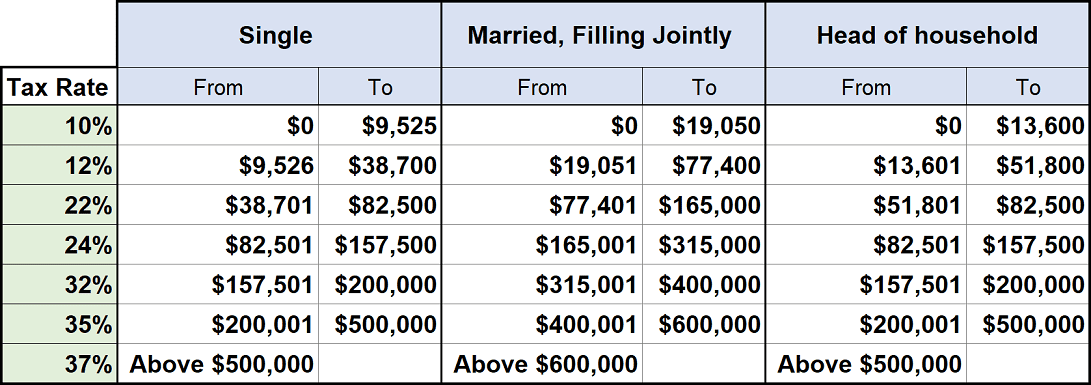

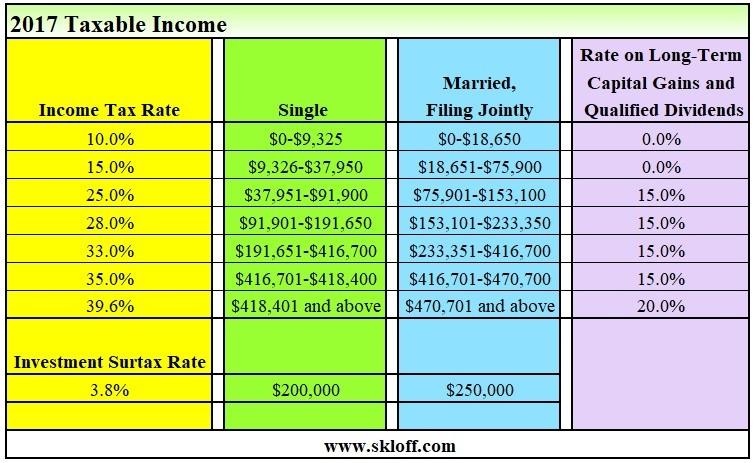

Income Tax and Capital Gains Rates 2017 - 04/01/17 - Skloff

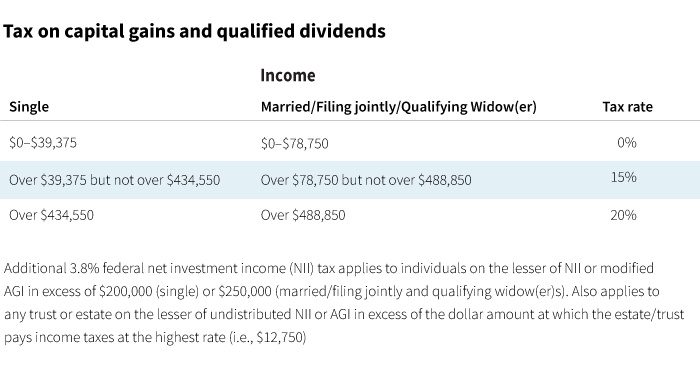

What is the effect of a lower tax rate for capital gains?

Qualified Dividend Income and Its Role in Capital Gains Treatment